- Our offer:

With more than 7,000 clients covered in loss of licence and 65 years of experience, SAAM VERSPIEREN Group is one of the most important actors of the loss of licence insurance market.

Moreover, CABIN SAAM is an offer insured by SWISS LIFE, one of Europe's leading comprehensive life and pensions and financial solutions providers. More than four million customers place their trust in their products and services.

You can get some more information about SWISS LIFE by clicking here.

Of course, our offer works as a top up insurance that comes in addition to any other payments received without any limitation.

Of course. You can subscribe if you are less than 50 years old and remain covered until your retirement.

You can also remain covered in case of death/TILA until the age of 75 years old.

No, unlike many other offers of the market, all of our coverage work in case of illness or accident regardless your age.

No, you are covered on and off duty, in case of illness or accident and until your retirement age! You can also remain covered in case of death until the age of 75 years old.

During the unemployment period, if you are less than 55 years old, your coverage is maintained for the period you are registered as job seeker subject to the maintenance and validity of the Approval to work in the profession or the medical certificate showing fitness to work as flight crew.

Of course. Our contract covers professional pilots worldwide. In case of any changes, you just need to notify us and we will update your contract.

- All-cause death & Total and Irreversible Loss of Autonomy coverage:

In case of death, the insurer pays the sum insured you have chosen to the beneficiary(ies) you have designated (or yourself in case of TILA).

From a mandatory minimum of 50,000€ up to 200,000€ within the limit of 5 times the annual gross salary.

For example: Laura is a cabin crew member with a gross annual salary of 30,000€, she can subscribe for a maximum of 150,000€.

Our death/TILA coverage offers your beneficiary(ies) a sum insured in order to help them financing:

- Day to day expenses;

- The payment of a loan;

- Scholarship fees;

- Etc.

- Permanent loss of licence coverage:

The permanent loss of licence covers you in case of the permanent suspension of your medical fitness certificate, causing you to cease your activity as a cabin crew member. You get covered on and off duty, in case of illness or accident, until you reach retirement age.

Up to 200,000€ limited to 3 times your gross annual salary Fro example: Laura is a cabin crew member with a gross annual salary of 30,000€, she can subscribe for a maximum of 90,000€.

Being a cabin crew member is a passion that requires time and financial investment. Injuries or accidents can occur and cause permanent loss of licence, preventing you from continuing your activity and from receiving a salary.

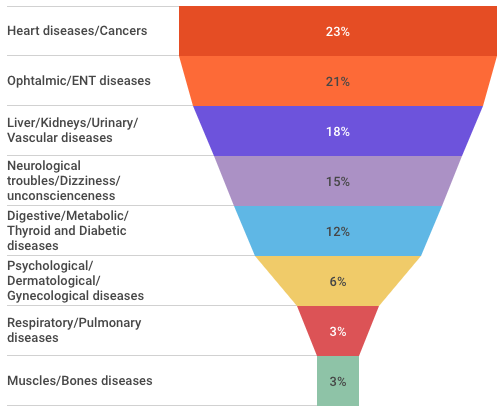

Main loss of licence causes:

<